UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington,

the Securities Exchange Act of 1934 (Amendment No. )

| | | |

| ||

2017 Proxy Statement

Piper JaffrayCompanies

| | ||||

| | | | | |

![[MISSING IMAGE: lg_pipersandlerpart-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/lg_pipersandlerpart-pn.jpg)

![[MISSING IMAGE: lg_pipersandler-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/lg_pipersandler-pn.jpg)

![[MISSING IMAGE: ph_chadabrahamnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_chadabrahamnew-bw.jpg)

March 29, 2017

25, 2022

Wewe look forward to seeing you at the annual meeting.

![[MISSING IMAGE: sg_chadabraham-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/sg_chadabraham-bw.jpg)

Chairman and Chief Executive Officer

| ||

Notice of Annual Meeting

of Shareholders

for the Annual Meeting of Shareholders to be held on May

![[MISSING IMAGE: sg_johnwgeelan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/sg_johnwgeelan-bw.jpg)

Secretary

| ||

March 29, 2017

PROPOSAL ONE—ELECTION OF DIRECTORS Stock Ownership Guidelines CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING The Board of Directors of Piper 25, 2022. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE less than $10,000 between Piper past three years. Majority Annual Board Evaluation Process Board. shareholders attended such virtual meeting. 900, Mail Stop J12NSH, Minneapolis, Minnesota 55402. Communications regarding accounting and auditing matters will be handled in accordance with our Complaint Procedures Regarding Accounting and Auditing Matters. Other communications will be collected by the secretary of the company and delivered, in the form received, to the lead director or, if so addressed, to a specified director. the Board considers when evaluating director candidates. The Governance Committee will reassess the qualifications of a director, including the re-election. Plan (the “Incentive Plan”). director. Any dividends that we pay on shares of our common stock are also credited as additional phantom shares to the William R. Fitzgerald B. Kristine Johnson Addison L. Piper Sherry M. Smith Philip E. Soran Scott C. Taylor Michele Volpi shareholders over the years to come. We use equity ownership to directly align the interests of our executive officers with those of our shareholders in creating long-term shareholder value. A significant portion of annual incentives company’s financial plan. The Committee the Committee. Andrew S. Duff Chairman and CEO Debbra L. Schoneman CFO Chad R. Abraham Global Co-Head of Investment Banking and Capital Markets Frank E. Fairman(4) Head of Public Finance R. Scott LaRue Global Co-Head of Investment Banking and Capital Markets Equity Grant Timing Policy Andrew S. Duff Chairman and CEO Debbra L. Schoneman CFO Chad R. Abraham Global Co-Head of Investment Banking and Capital Markets Frank E. Fairman Head of Public Finance(4) R. Scott LaRue Global Co-Head of Investment Banking and Capital Markets compensation). The following amounts earned Club membership dues 401(k) matching contributions Life and long-term disability insurance premiums Dividends from Mutual Fund Restricted Share Program Employer Health Savings Account Contribution Other Mr. Doyle’s all other compensation includes personal use of aircraft that the company has use of under a contract with FlexJet. Under this contract, the company pays certain hourly and monthly fees for its use of two different airplanes. The table above represents the threshold, target, and maximum number of shares of common stock that may be issued pursuant to the PSU The following table summarizes information with respect to the participation of the named executive officers in the Andrew S. Duff Severance(1) Restricted Compensation(2)(3) PSUs(4) Annual Incentive Award(5) Debbra L. Schoneman Severance(1) Restricted Compensation(2)(3) PSUs(4) Annual Incentive Award(5) Chad R. Abraham Severance(1) Restricted Compensation(2)(3) PSUs(4) Annual Incentive Award(5) Frank E. Fairman Severance(1) Restricted Compensation(2)(3) PSUs(4) Annual Incentive Award(5) R. Scott LaRue Severance(1) Restricted Compensation(2)(3) PSUs(4) Annual Incentive Award(5) Equity compensation plans approved by shareholders Equity compensation plans not approved by shareholders(2) Philip E. Soran All directors and executive officers as a group shares as of March 9.8 regulations of the SEC. Review and Approval of Transactions with Related Persons SEC. Audit Fees Audit-Related Fees(1) Tax Fees All Other Fees(2) Total annual process or if it may exceed pre-approved fee levels, the service must receive a specific and separate pre-approval by the Audit Committee, which has delegated authority to grant such pre-approvals during the year to the chairperson of the Audit Committee. Any pre-approvals granted pursuant to this delegated authority are reported to the Audit Committee at its next regular meeting. businesses. CONTENTS ” Carter. our annual meeting. The Notice of Internet Availability of Proxy Materials contains instructions on how to request a printed set of proxy materials, which we will provide to shareholders upon request at no cost to the requesting shareholder within three business days after receiving the request. ” What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or printed set of proxy materials? ” other nominee does not have voting discretion or has, but does not exercise, voting discretion, the uninstructed shares will be referred to as a ” proxy materials). The advisory votes on the compensation of our officers How are votes counted? ” materials). are soliciting proxies primarily through the distribution of Notices of Internet Availability of Proxy Materials. In addition, our directors, officers and regular employees may solicit proxies personally, telephonically, electronically or by other means of communication. Our directors, officers and regular employees will receive no additional compensation for their services other than their regular compensation. 5, 2023. Reconciliation of U.S. GAAP Financial Performance Figures a deferred tax asset valuation allowance, and (8) discontinued operations. For 2021 and 2020, the adjusted weighted average diluted common shares outstanding used in the calculation of adjusted earnings per diluted common share contains an adjustment to include the common shares for unvested restricted stock awards with service conditions granted pursuant to the acquisitions of Sandler O’Neill, The Valence Group and TRS Advisors LLC. A reconciliation of adjusted net revenues to U.S. GAAP net U.S. GAAP net revenues Adjustments: Revenue related to noncontrolling interests(1) Adjusted net revenues A reconciliation of adjusted net income to U.S. GAAP net income/(loss) applicable to Piper U.S. GAAP net income/(loss) applicable to Piper Jaffray Companies Adjustments: Compensation from acquisition-related agreements Restructuring and integration costs Goodwill impairment Amortization of intangible assets related to acquisitions Adjusted net income A reconciliation of adjusted earnings per diluted common share to U.S. GAAP earnings/(loss) per diluted common share: U.S. GAAP earnings/(loss) per diluted common share Adjustment for loss allocated to participating shares(1) Adjustments: Compensation from acquisition-related agreements Restructuring and integration costs Goodwill impairment Amortization of intangible assets related to acquisitions Adjusted earnings per diluted common share on important issues. Table of ContentsPROXY STATEMENT

TABLE OF CONTENTS

TABLE OF CONTENTS 1 INTRODUCTION 1 EXECUTIVE SUMMARY 67 1213 1213 1213 13 14 14 15 1516 19 Meeting Attendance 18 19 1820 1920 2021 2122 2223 2223 5249 5250 5452 5653 5754 5754 5955 56 57 6057 58 Outstanding Equity Awards 61SECURITY OWNERSHIP 6258 6258 6460 SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE 6661 6661 6661 6761 6863 6863 6963 6964 7165 7266 PROPOSAL FOUR—ADVISORY (NON-BINDING) VOTE ON THE FREQUENCY OF FUTURE SAY-ON-PAY VOTES 7668 8173 73 HOUSEHOLDING 81 8274 A-1 20172022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 11, 2017

6, 2022INTRODUCTIONJaffraySandler Companies is soliciting proxies for use at the annual meeting of shareholders to be held virtually on May 11, 2017,6, 2022, and at any adjournment or postponement of the meeting. NoticeThe notice of Internet Availability of Proxy Materials, which contains instructions on how to access this proxy statement and our annual report online, is first being mailed to shareholders on or about March 29, 2017.EXECUTIVE SUMMARY Date and Time: Thursday,Friday, May 11, 2017,6, 2022, at 2:00 p.m., local timeCentral Time Place:

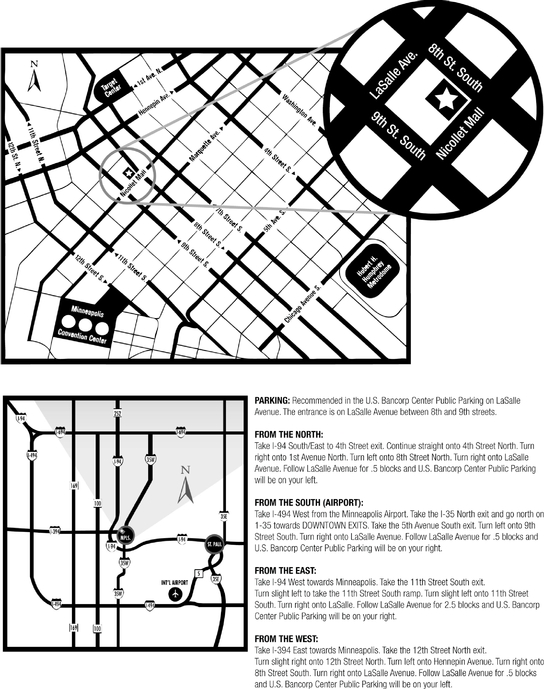

Website:The Huber Room in our Minneapolis Headquarters12th Floor, U.S. Bancorp Center800 Nicollet MallMinneapolis, Minnesota 55402 www.virtualshareholdermeeting.com/PIPR2022

Record Date:

March 15, 201710, 2022 Executive Summary and ONE YEAR for Proposal 4:Proposal Page Reference 1. Election of Directors 7 The Board of Directors believes the ten director nominees as a group have the experience and skills that are necessary to effectively oversee our company. 2. Ratification of Selection of Independent Auditor 63 The Audit Committee of our Board of Directors has selected Ernst & Young LLP to serve as our independent auditor for the year ending December 31, 2022. 3. Advisory (Non-Binding) Vote on Executive Compensation 64 The Board of Directors is asking shareholders to provide advisory approval of the compensation of the officers disclosed in this proxy statement, or a say-on-pay vote. Proposal Page Reference

1. Election of Directors 6

The Board of Directors believes the nine nominees as a group have the experience and skills that are necessary to effectively oversee our company.

2.

Ratification of Selection of Independent Auditor

71

The Audit Committee of our Board of Directors has selected Ernst & Young LLP to serve as our independent auditor for the year ending December 31, 2017.

3.

Advisory (Non-Binding) Vote on Executive Compensation

72

The Board of Directors is asking shareholders to provide advisory approval of the compensation of the officers disclosed in this proxy statement, or a say-on-pay vote.

4.

Advisory (Non-Binding) Vote on Frequency of Future Say-on-Pay Votes

75

The Board of Directors is asking shareholders to provide an advisory vote concerning the frequency of future say-on-pay votes.

Executive Summary How to Participate in the Virtual Meeting ![]()

![]()

![]()

Participate via the internet Voting during the meeting Submitting Questions To vote your shares during the meeting, click on the vote button provided on the screen and follow the instructions provided Questions may be submitted live during the meeting by typing them in the dialog box provided on the bottom corner of the screen

or 303-562-9302 (International Toll). Other Ways to Vote Your Shares ![]()

![]()

![]()

Internet Telephone Mail Dial 1-800-690-6903 and follow the instructions (have the proxy card in hand when you call) If you received paper copies of our proxy materials, mark your selection on the enclosed proxy card, date and sign your name, and promptly mail the proxy card in the postage-paid envelope provided Executive Summary 20162021 Performance Highlights

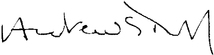

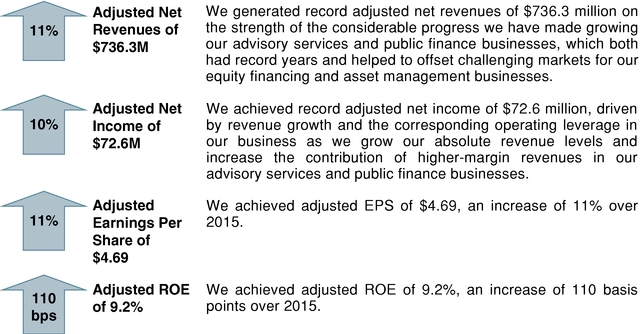

Highlights*2016, we achieved2021, our results reflected strong operating results, withexecution and high demand for our services, as well as the benefits of our more scaled and diversified platform. Our record adjusted net revenues, adjusted net income, and adjusted earnings per share and adjusted ROE*.reflect record performances across a number of our businesses. Our 20162021 performance highlights include:

Revenues We generated record adjusted net revenues of $1.98 billion.

Net Income We achieved record adjusted net income of $399.0 million.

Earnings Per Share We achieved record adjusted earnings per diluted common share (referred to in this proxy statement as “adjusted earnings per share”) of $21.92.

* and adjusted ROE (which are used throughout this proxy statement) are non-GAAP financial measures and are further defined and reconciled to the most directly comparable GAAP financial measure in the Appendix A to this proxy statement. Executive Summary nineten directors for election at the 20172022 annual meeting:meeting of shareholders: our CEOchairman and chief executive officer, our head of financial services group, and eight other currently serving directors. Seven of these nineten directors are independent under New York Stock Exchange Rules. OurThe Board of Directors has determined that both our CEOchairman and chief executive officer, Mr. Abraham, our head of financial services group, Mr. Doyle, and Mr. Frazier, who joined the Board of Directors in connection with our acquisition of Simmons & Company International ("Simmons") in 2016,Sterling are not independent. Other than Ms. Mitchell, each nominee was elected by the shareholders at the 2021 annual meeting. Ms. Mitchell is standing for election by our shareholders as a director of the company for the first time at this year’s annual meeting. Ms. Mitchell was identified and introduced to the Board by a third-party search firm, and was elected to serve as a director effective September 27, 2021. Each director was evaluated by the Nominating and Governance Committee in advance of its recommendation of their respective service as a director. Mr. Abraham was elected to serve as chairman of the Board beginning in May 2019. Mr. Soran has served as our lead director since February 2018.67 through 1112 of this proxy statement. ![[MISSING IMAGE: ph_chadabrahamnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_chadabrahamnew-bw.jpg)

![[MISSING IMAGE: ph_jondoyle-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_jondoyle-bw.jpg)

![[MISSING IMAGE: ph_williamfitzgerald-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_williamfitzgerald-bw.jpg)

![[MISSING IMAGE: ph_holtvictoria-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_holtvictoria-bw.jpg)

![[MISSING IMAGE: ph_mitchellrobbin-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_mitchellrobbin-bw.jpg)

Chad R. Abraham

Andrew S. DuffWilliam R. Fitzgerald Michael E. FrazierVictoria M. Holt B. Kristine Johnson Addison L. PiperRobbin Mitchell

Chairman and CEO of Piper JaffraySandler Companies

Vice Chairman and Head of Financial Services Group of Piper Sandler Companies Former Chairman and CEO of Ascent Capital Group

Former CEO of Simmons & Company International

President of Affinity Capital ManagementFormer Chairman and CEO of Piper Jaffray CompaniesProto Labs, Inc. Senior Advisor for Boston Consulting Group ![[MISSING IMAGE: ph_schreiertomnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_schreiertomnew-bw.jpg)

![[MISSING IMAGE: ph_sherrysmithnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_sherrysmithnew-bw.jpg)

![[MISSING IMAGE: ph_philipsoran1-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_philipsoran1-bw.jpg)

![[MISSING IMAGE: ph_briansterling-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_briansterling-bw.jpg)

![[MISSING IMAGE: ph_scotttaylor-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_scotttaylor-bw.jpg)

Thomas S. Schreier

Chair Governance;Lead Director

Sherry M. Smith Philip E. Soran Brian R. Sterling Scott C. Taylor Michele Volpi

Former Chairman of Nuveen Asset Management

Lead Director

Former Managing Director of Piper Sandler Companies, former Co-Head of Investment Banking at Sandler O’Neill & Partners, L.P. SymantecCEO of PraesidiadChair Audit

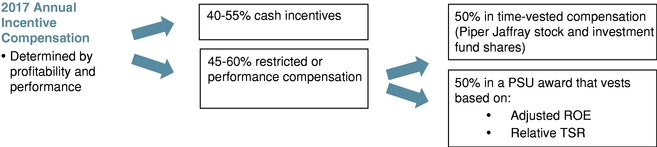

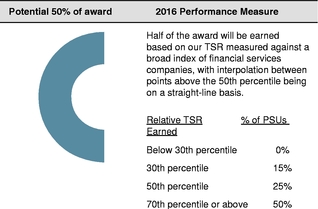

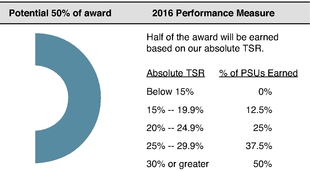

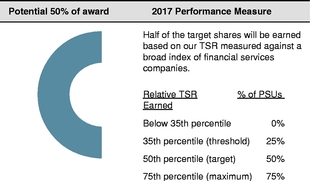

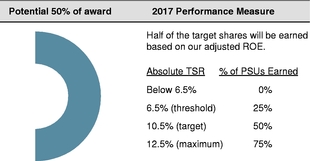

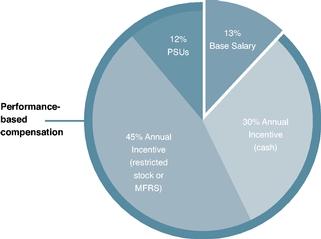

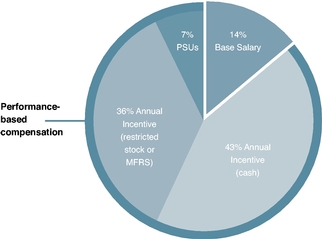

NortonLifeLock Inc. Executive Summary Following our 2016 annual meeting of shareholders, our Compensation Committee sought to engage with our 25 largest shareholders to solicit their perspectives on our executive compensation program. Following that engagement, our Compensation Committee approved significant changes to our executive compensation program. These changes are as follows:Compensation Committee ActionExplanation 1.Decreased the amount of time-vested restricted compensation andincreased long-term performance share unit ("PSU") awards.The Compensation Committee revised the executive compensation program to reduce the amount of annual incentives paid in time-vested restricted compensation, and increase the amount of long-term PSU awards. Beginning with annual incentives for 2017 performance, our named executive officers will receive 50% of their restricted compensation in the form of long-term PSU awards that vestonly if certain long-term total shareholder return ("TSR") and adjusted ROE targets are achieved. 2.Revised PSU award metrics to include:• Adjusted ROE; and• Relative TSR.The Compensation Committee revised the February 2017 PSU awards to focus on two key metrics: (1) adjusted ROE and (2) relative TSR. Adjusted ROE was selected because increasing our profitability and making efficient use of capital are clear demonstrations of creating shareholder value. Relative TSR was selected because it shows the returns we are providing our shareholders in relation to a broad index of financial services companies. 3.Capped annual cash incentives for our CEO, CFO, and President.The Compensation Committee implemented a cap on annual incentives that can be paid in cash to our CEO, CFO, and President at three times their base salaries. The cap on annual incentives went into effect in our 2016 executive compensation program,![[MISSING IMAGE: tm223392d1-pc_summarypn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-pc_summarypn.jpg)

the revised PSU award was first awarded in February 2017. The change outlined above with respect to the decrease in time-vested restricted compensation and increase in long-term PSU awards will first be implemented with respect to annual incentives paid in February 2018 for 2017 performance. In addition to these changes, our 2016 executive compensation program retained our core pay-for-performance philosophy which includes: (1) base salary, (2) annual incentive compensation based on the achievement of a measure of pre-tax operating income, and (3) a long-term incentive award in the form of PSUs that will be earned based on our total and relative shareholder return. The most significant actions taken during 2016qualifications represented by the Compensation Committee include:•Base Salaries:director nominees The base salaries of our named executive officers have remained unchanged since 2010.![[MISSING IMAGE: tm223392d1-tbl_skillspn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-tbl_skillspn.jpg)

Executive SummaryProposal One: Election of Directors ![[MISSING IMAGE: tm2025328d59-ban_proponepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm2025328d59-ban_proponepn.jpg)

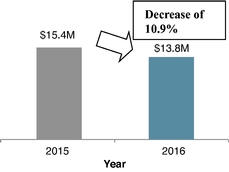

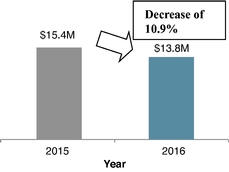

•Annual Incentive Compensation: We achieved strong operating results in 2016, including record adjusted net revenues and adjusted earnings per share, and we executed against our strategic growth strategy. Even though our profitability was up in 2016 from 2015, our named executive officers' overall annual incentive compensation declined approximately 10.9% from 2015. This was primarily due to our Compensation Committee's decision to exclude a portion of the additional earnings contributed by Simmons during the year from consideration from the annual incentive compensation for those named executive officers that have responsibility over our investment banking and capital markets business. These earnings were excluded to account for the amount of capital that was invested in the business in connection with the Simmons acquisition. Our CEO's annual incentive compensation based on 2016 performance was $3,908,700, resulting in a 3.1% decrease in his annual incentive compensation from 2015. The annual incentive compensation for our other named executive officers ranged from $1,329,750 to $3,425,000. These amounts represented decreases in the annual incentive compensation paid of 2.9% to our CFO, and 16.0% and 25.8% to our global co-heads of investment banking, respectively, and an increase of 10.1% in the annual incentive compensation paid to our head of public finance.•Long-Term Incentive Awards: Beginning with the February 2017 grant, our PSU award program was revised to include the following performance metrics: (1) adjusted ROE, and (2) relative TSR. The PSU award will be earned by each executive officer only if over the 36-month performance period we achieve a certain adjusted ROE and relative TSR compared to a broad index of financial services companies. Beginning in February 2018, the PSU award will become a more significant vehicle through which we deliver our executive officers' total incentive compensation. The award, which has historically been for a fixed amount, will be granted in lieu of a portion of the restricted compensation currently granted as annual incentive compensation based on business line and overall company profitability and individual performance. This change will effectively reduce annual incentives, and increase the amount of the PSU awards that vest only if certain long-term adjusted ROE and relative TSR metrics are achieved. In May 2016, the Compensation Committee made its final grant of our historical PSU award program, which will vest based on absolute and relative TSR performance metrics. The amount of the PSU awards granted in May 2016 and February 2017 was essentially unchanged from 2015.

of Directors (the "Board") has nominated all nineten current members of the Board for election at the 20172022 annual meeting. These individuals are Andrew S. Duff,Chad R. Abraham, Jonathan J. Doyle, William R. Fitzgerald, Michael E. Frazier, B. Kristine Johnson, Addison L. Piper,Victoria M. Holt, Robbin Mitchell, Thomas S. Schreier, Sherry M. Smith, Philip E. Soran, Brian R. Sterling and Scott C. TaylorTaylor. Other than Ms. Mitchell, each nominee was elected by the shareholders at the 2021 annual meeting. Ms. Mitchell is standing for election by our shareholders as a director of the company for the first time at this year’s annual meeting. Ms. Mitchell was identified and Michele Volpi. introduced to the Board by a third-party search firm.director'sdirector’s election. Any nominee failing to receive a majority will tender his or her resignation to the Board, which shall decide whether to accept or reject the resignation. For more information on our majority voting standard and director resignation policy, please see the section titled "Board“Information Regarding the Board of Directors and Corporate Governance—Majority Voting Standard and Director Resignation Policy"Policy” below. Proxies may not be voted for more than nineten directors. If, for any reason, any nominee becomes unable to serve before the annual meeting occurs, the persons named as proxies may vote your shares for a substitute nominee selected by ourthe Board.nineten director nominees. Proxies will be voted FOR the election of the nineten nominees unless otherwise specified.person'sperson’s service as a director, work experience, and the experiences, qualifications, attributes or skills that causedled the Nominating and Governance Committee and ourthe Board to determine that the person should serve as a director. Each nominee brings unique capabilities to the Board. The Board believes the nominees as a group have the experience and skills in areas such as senior level management, corporate governance, leadership development, investment banking, asset management,capital markets, finance, and risk management that are necessary to effectively oversee our company. In addition, the Board believes that each of our directorsdirector nominees possesses high standards of ethics, integrity and professionalism, sound judgment, community leadership, and a commitment to representing the long-term interests of our shareholders. Proposal One: Election of Directors Chad R. Abraham, Chairman

![[MISSING IMAGE: ph_chadabrahamnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_chadabrahamnew-bw.jpg)

Chad R. AbrahamAndrew S. Duff

Age 5953

Director since 20032018

DuffAbraham has served as chairman andbeen our chief executive officer since 2018 and chairman of Piper Jaffray Companiesthe Board since December 31, 2003. Mr. Duff became chairman andMay 2019. Prior to being appointed chief executive officer, following completionMr. Abraham previously served as our global co-head of investment banking and capital markets since 2010. He was head of capital markets from 2005 to 2010, and managing director and head of our spin-offtechnology investment banking group from U.S. Bancorp on December 31, 2003. He has served1999 to 2005. Mr. Abraham began his career at Piper Sandler in 1991 as chairman of our broker-dealer subsidiary since 2003 and as chief executive officer of our broker-dealer subsidiary since 2000.an investment banking analyst.DuffAbraham has more than 30 years of experience in the investment banking and capital markets industry with Piper Jaffray,Sandler, including as our global co-head of investment banking and has been our chairman and chief executive officer since our spin-offcapital markets from U.S. Bancorp in 2003.2010 to 2017. The Board believes he has the knowledge of our company and its business that is necessary to help formulate and execute our business plans and growth strategies.PreviousCurrent Directorships:•Arctic Cat Inc. (October 2015 to March 2017)

Jonathan J. Doyle

![[MISSING IMAGE: ph_jondoyle-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_jondoyle-bw.jpg)

Age 57

Director since 2020 Proposal One: Election of Directors William R. Fitzgerald ![[MISSING IMAGE: ph_williamfitzgerald-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_williamfitzgerald-bw.jpg)

Age 5964

Director since 2014JaffraySandler

Board Committees:AuditCompensation has been thewas chairman and chief executive officer of Ascent Capital Group, Inc. since August 2000.from 2000 to 2019, and was its chief executive officer from 2000 to 2018. Ascent Capital Group (formerly known as Ascent Media Group) iswas a publicly traded holding company whose current business operations are conducted throughwhich was ultimately merged with its wholly owned operating subsidiary, Monitronics International, Inc., which offers business and home security alarm monitoring services. In addition, Mr. Fitzgerald previously served as senior vice president of Liberty Media Corporation from July 2000 to December 2012. Mr. Fitzgerald served as executive vice president and chief operating officer for AT&T Broadband (formerly known as Tele-Communications, Inc.) from 1998 to 2000, and as executive vice president, corporate development of TCI Communications, Inc., a wholly-owned subsidiary of Tele-Communications, from 1996 to 1998. Mr. Fitzgerald was previously an investment banking partner with Daniels and Associates (now RBC Capital Markets), and he began his career as a commercial banker at The First National Bank of Chicago.ourthe Board significant management experience from his more than 30 years in the media and telecommunications industries, including his current role as chairman and chief executive officerCEO of Ascent Capital Group.a publicly traded company. In addition, Mr. Fitzgerald'sFitzgerald’s experience as a partner at a middle-market investment bank and public company director provides valuable experience to our management and to the Board.Current Directorships:Previous Directorships Held within the Last Five Years:• Victoria M. Holt ![[MISSING IMAGE: ph_holtvictoria-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_holtvictoria-bw.jpg)

Age 64

Director since 2019

Board Committees: •Expedia,(March 2006(2014 to December 2012)•TripAdvisor, Inc. (December 2011 to February 2013) Proposal One: Election of Directors Robbin Mitchell ![[MISSING IMAGE: ph_mitchellrobbin-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_mitchellrobbin-bw.jpg)

Michael E. Frazier

Age 6758

Director since 2021

Board Committees: Thomas S. Schreier

![[MISSING IMAGE: ph_schreiertomnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_schreiertomnew-bw.jpg)

Age 59

Director since 2018

Board Committees: Frazier began with Simmons & Company International, an investment bank specializing inSchreier was the energy industry, in 1992. He became presidentvice chairman of Simmons in 2002, chief executive officer in 2005,Nuveen Investments, Inc., and chairman in 2009,of its largest investment adviser, Nuveen Asset Management, from 2011 to 2014, and, served in those capacities until the closing of ourfollowing Nuveen’s acquisition of Simmons in Februaryby TIAA, from 2014 to 2016. Following the acquisition, Mr. Frazier served as a consultant to Piper Jaffray & Co. under a consulting agreement that terminated on February 26, 2017. Prior to joining Simmons in 1992,that, Mr. FrazierSchreier was actively involved in the exploration and production of oil and gas as an independent operator.Qualifications: Mr. Frazier has extensive experience in the capital markets industry and in the energy investment banking sector specifically, which we recently entered with our acquisition of Simmons. He also has extensive industry executive management experience as the former chief executive officer of Simmons.Other Current Directorships:•NOW Inc.

B. Kristine JohnsonAge 65Director since 2003

FAF Advisors from 2001 to 2010, when it was acquired by Nuveen. Earlier in his career, Mr. Schreier was a senior managing director and head of equity research at Piper JaffrayBoard Committees:Sandler from 1999 to 2001.•Governance (Chair)Principal OccupationQualifications: Ms. JohnsonMr. Schreier has been president of Affinity Capital Management, a Minneapolis-based venture capital firm that invests primarily in seed and early-stage healthcare companiesextensive leadership experience in the United States, since 2000. Ms. Johnson previously was employed for 17 years at Medtronic, Inc.,financial services sector, including as a leading medical device manufacturer, serving most recently as senior vice president and chief administrative officer.Qualifications: Ms. Johnson has extensiveleader of significant asset management companies. This leadership experience in both the health care industry and the venture capital business, with the health care industry being one of the primary areas of focus of ourhuman capital-based businesses such as ours, as well as his investment banking business. Her deep tiesindustry experience, provides significant value to the health care industry and the venture capital business provide the Board with valuable insights and knowledge, both from a client and public company perspective.Lead Director: Ms. Johnson currently serves as the lead director of our Board.Other Current Directorships:•The Spectranetics Corporation•AtriCure, Inc. Proposal One: Election of Directors

Addison L. PiperAge 70Director since 2003Principal Occupation: Mr. Piper worked for Piper Jaffray from 1969 through 2006, serving as chief executive officer from 1983 to 2000 and as chairman from 1988 to 2003. He also served as vice chairman of Piper Jaffray Companies following the completion of our spin-off from U.S. Bancorp, and retired from that role effective at the end of 2006. From 1998 through August 2006, Mr. Piper had responsibility for our venture and private capital fund activities. During his earlier career with Piper Jaffray, he served as assistant equity syndicate manager, director of securities trading, and director of sales and marketing.Qualifications: Mr. Piper has been a part of our company since 1969, serving in many roles, including chief executive officer. His experience with the company provides deep institutional knowledge as well as a comprehensive understanding of the financial services industry.

Sherry M. Smith ![[MISSING IMAGE: ph_sherrysmithnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_sherrysmithnew-bw.jpg)

Age 5560

Director since 2016

Piper JaffraySandler

Board Committees:Compensation•Governance thaton which she has served, on, Ms. Smith has extensive public company financial, accounting, and risk management experience, which provides valuable insight and skills for a director of a publicly traded securities firm such as our company.••• Proposal One: Election of Directors

Philip E. Soran ![[MISSING IMAGE: ph_philipsoran1-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_philipsoran1-bw.jpg)

Age 6065

Director since 2013JaffraySandler

Board Committees:Audit• Soran'sSoran’s experience founding and building technology companies provides strategic guidance to the Board and management, and his experience in the technology industry is valuable to the company as it is a focus area for our investment banking business. He also has extensive management experience as a former chief executive officer of a publicly traded company of a similar size to our company. Mr. Soran'sSoran’s perspective as a board member of another publicly traded company also provides valuable insight to the Board.•(October 2011(2011 to October 2016) Proposal One: Election of Directors

Brian R. Sterling

![[MISSING IMAGE: ph_briansterling-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_briansterling-bw.jpg)

Age 61

Director since 2021 Scott C. Taylor ![[MISSING IMAGE: ph_scotttaylor-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/ph_scotttaylor-bw.jpg)

Age 5257

Director since 2014JaffraySandler

Board Committees:Audit (Chair) servesserved as Executive Vice Presidentexecutive vice president, general counsel, and General Counselsecretary for NortonLifeLock Inc. (formerly Symantec Corporation,Corp.), a NASDAQ-listed informationpublicly traded computer security solutions company, a position he has held sincesoftware provider, from August 2008.2008 through January 2020. Mr. Taylor'sTaylor’s prior experience includes positions as chief administrative officer, senior vice president and general counsel of Phoenix Technologies Ltd. Prior to that, he was vice president and general counsel of Narus, Inc. In addition, Mr. Taylor was previously anbegan his legal career as a corporate attorney at Pillsbury Madison and Sutro LLP (now Pillsbury Winthrop Shaw Pittman LLP).PreviousCurrent Directorships:•VirnetX Holding Corporation (February 2008 to May 2014) Proposal One: Election of Directors

Michele VolpiAge 53Director since 2010Piper JaffrayBoard Committees:•Compensation (Chair)Principal Occupation: Mr. Volpi has served as the chief executive officer of Praesidiad (formerly Betafence Corporate Services), a global provider of physical security solutions located in Belgium, since November 2011. Prior to joining Praesidiad, Mr. Volpi served as president, chief executive officer, and director of H.B. Fuller Company from December 2006 to November 2010. H.B. Fuller is a publicly traded company that manufactures and markets adhesives and specialty chemical products worldwide.Qualifications: Mr. Volpi has significant management experience, including from his current position as chief executive officer of Praesidiad and his previous role as president, chief executive officer, and director of H.B. Fuller Company. Mr. Volpi's extensive management experience, including his experience as a chief executive officer of a publicly traded company, provides valuable perspective, insight, and strategic guidance to our management and to the Board.![[MISSING IMAGE: tm2025328d59-box_boardpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm2025328d59-box_boardpn.jpg)

www.piperjaffray.comwww.pipersandler.com, under the heading "Corporate“Corporate Governance,"” together with our Corporate Governance Principles, Director Independence Standards, Director Nominee Selection Policy, Procedures for Contacting the Board of Directors, Codes of Ethics and Business Conduct, and Complaint Procedures Regarding Accounting and Auditing Matters.principal executive officer, principal financial officer, principal accounting officer, controller and other employees performing similar functions,officers, and a separate Code of Ethics and Business Conduct applicable to our directors. Directors who also serve as officers of Piper JaffraySandler must comply with both codes. Both codes are available on the Investor Relations page of our website atwww.piperjaffray.comwww.pipersandler.com, under the heading "Corporate“Corporate Governance."” We will post on our website atwww.piperjaffray.comwww.pipersandler.com any amendment to, or waiver from, a provision of either of our Codes of Ethics and Business Conduct within four business days following the date of such amendment or waiver.Jaffray.Sandler. To assist the Board with these determinations, the Board has adopted Director Independence Standards, which are available on the Investor Relations page of our website atwww.piperjaffray.com,www.pipersandler.com, under the heading "Corporate“Corporate Governance."”Frazier,Sterling, none of our non-employee directors has a material relationship with Piper JaffraySandler and that each of them is independent. When determining the independence of our independent directors, the Board considered the following types of transactions or arrangements:arrangements during 2021: (i) with respect to each of Mr. Soran and Ms. Johnson and Mr. Taylor,Mitchell, the Board considered immaterial commercial relationships involving Piper Jaffray andgrants in the director's primary business affiliation; (ii) with respect to Messrs. Piper and Soran and Ms. Smith, the Board considered an immaterial relationship arising solely because an immediate family member is an employeeamounts of another company that provides services to the company; (iii) with respect to Messrs. Piper and Taylor and Mses. Johnson and Smith, the Board considered immaterial relationshipsBoard of Directors and Corporate GovernanceJaffraySandler and charitable foundations or other non-profit organizations with which each of those directors is associated; (iv) with respect to Ms. Johnson, the Board considered an immaterial commercial relationship (i.e., less than $500) resulting from a trading account Ms. Johnson maintains with Piper Jaffray on the same terms and conditions that apply to other similarly situated clients; and (v) with respect to Ms. Johnson and Mr. Soran, the Board considered their respective investments in one of our investment funds on substantially the same terms as similarly situated investors. All of theseassociated. These relationships are deemed to be immaterial under our Director Independence Standards.Mr. Duff cannothe is employed as our chief executive officer.Messrs. Abraham and Doyle are current employees of Piper Sandler, and because Mr. Frazier cannot be consideredSterling was an independent director under those same rules because we entered into a consulting agreement with Mr. Frazier in connection withemployee of Piper Sandler within the closing of our acquisition of Simmons in February 2016. This consulting agreement terminated in February 2017.served inno policy with respect to the combinedseparation of the offices of chairman and chief executive officer, and it believes the determination of whether to combine the roles of chairman and chief executive officer. Since 2006, Board of Directors and Corporate Governance appointed a lead director, of the Board. Ms. Johnson currently serves as the lead director. Thea position which has been held by Mr. Soran since February 2018. Our lead director has the following duties and responsibilities, as further described in our Corporate Governance Principles:••monitorssets Board meeting schedules and agendas to ensure that appropriate matters are covered and that there is sufficient time for discussion of all agenda items;•••herselfhimself available for consultation and direct communication.The Board believes that Mr. Duff's combined service as chairman and chief executive officer continues to be in the best interests of shareholders and the company given Mr. Duff's perspective and experience, and that the combination of the roles under Mr. Duff provides unified leadership for the Board and the company, with one cohesive vision for our organization. As chairman and chief executive officer, Mr. Duff helps shape the strategy ultimately set by the entire Board and leverages his operational experience to balance growth and risk management. We believe the oversight provided by the Board's independent directors, the work of the Board's committees described below and the coordination between the chief executive officer and the independent directors conducted by the lead director help provide effective oversight of our company's strategic plans and operations. The Board believes having one person serve

Board of Directors and Corporate Governanceas chairman and chief executive officer is in the best interests of our company and our shareholders at this time; however, the Board has no policy with respect to the separation of the offices of chairman and chief executive officer, and the Board believes the determination of whether to combine the roles of chairman and chief executive officer is a part of the succession planning process, which the Board oversees.VoteVoting Standard and Director Resignation Policy"bylaws"“bylaws”) provide for a majority voting standard in uncontested director elections. Each nominee in an uncontested election will be elected by the vote of a majority of the votes cast with respect to that director'sdirector’s election. For these purposes, a majority of votes cast means that the number of votes cast "for"“for” a director'sdirector’s election exceeds the number of votes cast "against"“against” that director'sdirector’s election. "Abstentions"“Abstentions” and "broker non-votes"“broker non-votes” will not be counted as votes cast either "for"“for” or "against"“against” a director'sdirector’s election. Contested director elections will continue to be decided by a plurality vote. Our bylaws require any director nominee failing to receive a majority of the votes cast in an uncontested director election to promptly tender his or her resignation to the Board. Within 90 days of certification of the election results, the Nominating and Governance Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken, and the Board will publicly disclose its decision regarding the tendered resignation and the rationale behind thesuch decision. The director who tenders his or her resignation will not participate in the recommendation of the Nominating and Governance Committee or the decision of the Board with respect to his or her resignation. For additional information regarding the majority voting standard, see Article II, Section 2.3 of our bylaws.company'scompany’s management is responsible for defining the various risks facing the company, formulating risk management policies and procedures, and managing the company'scompany’s risk exposures on a day-to-day basis. The Board'sBoard’s responsibility is to monitor the company'scompany’s risk management processes by informing itself concerning the company'scompany’s material risks and evaluating whether management has reasonable controls in place to address the material risks. The Board is not responsible for defining or managing the company'scompany’s various risks. The Board has allocated responsibility for oversight of specific risks between Board of Directors and Corporate Governance •Board of Directors—The entire Board is responsible for oversight of our major risk exposures related to our corporate strategy.•Audit Committee—The Audit Committee is responsible for oversight of our risk assessment and management framework, and in that role oversees management's processes for identifying and evaluating our major risks, and the policies, procedures, and practices employed by management to govern the risk assessment and risk management framework. The Audit Committee is also responsible for oversight of the major risk exposures in the areas of market risk, credit risk, liquidity risk, legal and regulatory risk, operational risk, and human capital risks relating to misconduct and fraud. Corporate Ethics

Committee

Committee Governance and Nominating Committee

(with shared

Board oversight)

(fraud and misconduct)

risk oversight structure •Compensation Committee—The Compensation Committee is responsible for oversight of our major risk exposures relating to compensation, organizational structure, and succession.•Nominating and Governance Committee—The Nominating and Governance Committee is responsible for overseeing the Board of Directors' committee structures and functions as they relate to risk oversight.Mr. DuffMessrs. Abraham, Doyle, and Sterling and other members of management do not participate. Our independent directors meet regularly in executive session without any of Messrs. Duff and Frazier,Abraham, Doyle, or Sterling, the only non-independent directors under New York Stock Exchange rules. Ms. Johnson,Mr. Soran, our lead director, serves as the presiding director at executive sessions of the Board, and the chairperson of each committee serves as the presiding director at executive sessions of thatsuch committee. Board of Directors and Corporate Governance

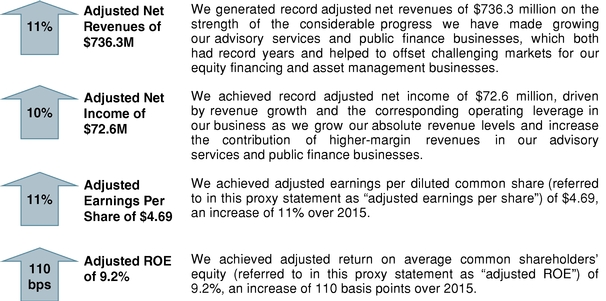

![[MISSING IMAGE: tm223392d1-tbl_committebw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-tbl_committebw.jpg)

Duff, Frazier, and Piper do not currentlyAbraham, Doyle, or Sterling serve on any of the committees of the Board. Board of Directors and Corporate Governance Audit CommitteeThe Audit Committee's purpose is to oversee the integrity of our financial statements, the independent auditor's qualifications and independence, the performance of our internal audit function and independent auditor, and compliance with legal and regulatory requirements.The Audit Committee has sole authority to retain and terminate the independent auditor and is directly responsible for the compensation and oversight of the work of the independent auditor. In connection with the Audit Committee's determination of whether to retain the independent auditor or engage another firm as our independent auditor, the Audit Committee annually reviews the independent auditor's performance and independence, taking into consideration the following:•the quality of the Audit Committee's ongoing discussions with the independent auditor;•management's perceptions of the independent auditor's expertise and past performance;•the appropriateness of fees charged; and•the independent auditor's independence qualification, including the independent auditor's provision of any permissible non-audit services and the related fees received for such services, as further described below in the section titled "Audit Committee Report and Payment of Fees to our Independent Auditor—Auditor Fees".In addition, as discussed above, the Audit Committee is responsible for oversight of our risk assessment and management framework, and in that role oversees management's processes for identifying and evaluating our major risks, and the policies, procedures, and practices employed by management to govern the risk assessment and risk management framework. The Audit Committee is also responsible for oversight of the major risk exposures in the areas of market risk, credit risk, liquidity risk, legal and regulatory risk, operational risk, and human capital risks related to fraud and misconduct.The Audit Committee also meets with management and the independent auditor to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in the proxy statement.The responsibilities of the Audit Committee are more fully described in the Committee's charter. The Audit Committee met ten times during 2016. The Board has determined that all members of the Audit Committee are independent (as that term is defined in the applicable New York Stock Exchange rules and in regulations of the Securities and Exchange Commission), that all members are financially literate and have the accounting or related financial expertise required by the New York Stock Exchange rules, and that Mr. Taylor qualifies as an "audit committee financial expert" as defined by regulations of the Securities and Exchange Commission.Compensation CommitteeThe Compensation Committee discharges the Board's responsibilities relating to compensation of the executive officers and ensures that our compensation and employee benefit programs are aligned with our compensation and benefits philosophy. These responsibilities also include reviewing and

Sherry M. Smith (Chair)

Robbin Mitchell

Thomas S. Schreier

Scott C. Taylor

in 2021: 12 Board of Directors and Corporate Governance discussing with management whether the company's compensation arrangements are consistent with effective controls and sound risk management, and overseeing our major risk exposures relating to compensation, organizational structure, and succession. The Committee has full discretion to determine the amount of compensation to be paid to the executive officers. The Committee also has sole authority to evaluate the chief executive officer's performance and determine the compensation of the chief executive officer based on this evaluation. The Committee is responsible for recommending stock ownership guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to our non-employee directors, for reviewing and approving the establishment of broad-based incentive compensation, equity-based, retirement or other material employee benefit plans, and for discharging any duties under the terms of these plans.The Committee has delegated authority to our chief executive officer under our Amended and Restated 2003 Annual and Long-Term Incentive Plan (the "Incentive Plan") to allocate awards to employees (other than our executive officers) in connection with our annual restricted stock grants made in the first quarter of each year (as part of the payment of incentive compensation for the preceding year). Under this delegated authority, the Committee approves the aggregate amount of equity to be awarded to all employees other than executive officers, and the chief executive officer approves the award recipients and specific amount of equity to be granted to each recipient. All other terms of the awards are determined by the Committee. The Committee also has delegated authority to the chief executive officer to grant restricted stock awards to employees other than executive officers in connection with recruiting and retention. This delegation permits the chief executive officer to determine the recipient of the award as well the amount of the award, subject to an annual share limitation set by the Committee each year. All awards granted pursuant to this delegated authority must be made in accordance with our equity grant timing policy described below in "Compensation Discussion and Analysis—Compensation Policies—Equity Grant Timing Policy." All other terms of the awards are determined by the Committee.The work of the Committee is supported by our human capital department, primarily through our chief human capital officer, our finance department, primarily through our chief financial officer, and by our legal department, primarily through our general counsel and assistant general counsel, who prepare and present information and recommendations for review and consideration by the Committee. These personnel work closely with the Committee chair and, as appropriate, our chief executive officer. For more information, refer to the section below titled "Compensation Discussion and Analysis—How Compensation Decisions are Made—Involvement of Executive Officers."The Compensation Committee has sole authority to engage, retain, and terminate independent compensation consultants, and has retained Frederic W. Cook & Co., to provide strategic planning, market context, and general advice to the Committee with respect to executive compensation, as described below under "Compensation Discussion and Analysis—How Compensation Decisions are Made—Compensation Consultant."The Compensation Committee reviews and discusses with management the disclosures regarding executive compensation to be included in our annual proxy statement, and recommends to the Board inclusion of the Compensation Discussion and Analysis in our annual proxy statement. The responsibilities of the Compensation Committee are more fully described in the Committee's charter. For more information regarding the Committee's process in setting compensation, please see "Compensation Discussion and Analysis—How Compensation Decisions are Made" below. The Compensation Committee met eight times during 2016. The Board has determined that all members of the Compensation Committee are independent (as that term is defined in applicable New York Stock Exchange rules).

Scott C. Taylor (Chair)

William R. Fitzgerald

Thomas S. Schreier

Sherry M. Smith Board of Directors and Corporate Governance

Philip E. Soran (Chair)

William R. Fitzgerald

Victoria M. Holt

in 2021: 4 Nominating and Governance CommitteeThe Nominating and Governance Committee identifies and recommends individuals qualified to become members of the Board and recommends to the Board sound corporate governance principles and practices for Piper Jaffray. In particular, the Committee assesses the independence of our Board members, identifies and evaluates candidates for nomination as directors, responds to director nominations submitted by shareholders, recommends the slate of director nominees for election at the annual meeting of shareholders and candidates to fill vacancies between annual meetings, recommends qualified members of the Board for membership on committees, oversees the director orientation and continuing education programs, reviews the Board's committee structure, reviews and assesses the adequacy of our Corporate Governance Principles, and oversees the annual evaluation process for the chief executive officer, the Board, and Board committees. With respect to risk oversight, the Nominating and Governance Committee is responsible for overseeing the Board's committee structures and functions as they relate to risk oversight. The Nominating and Governance Committee also oversees administration of our related person transaction policy and reviews the transactions submitted to it pursuant to such policy. The responsibilities of the Nominating and Governance Committee are more fully described in the Committee's charter. The Nominating and Governance Committee met eight times during 2016. The Board has determined that all members of the Nominating and Governance Committee are independent (as that term is defined in applicable New York Stock Exchange rules). Nominating and Governance Committee oversees the Board'sBoard’s annual evaluation process. In connection with this process, every year our lead directorthe Governance Committee chair interviews each director and members of management concerning the effectiveness of the Board and its committees, including in the areas of strategic prioritization, risk oversight, director engagement, and management accountability. Our lead directorThe Governance Committee chair then reviews and discusses information from these interviews with the Board and its committees. Each of our committee chairs includes any feedback received concerning the committee in its annual self-evaluation, which is discussed by each committee at its final meeting of the year.next regular meeting. The results of each committee'scommittee’s self-evaluation are reported to the full Board of Directors at its final meeting of the year.2016.2021. Each of our current directors attended at least 75% of the meetings of the Board and the committees on which he or she served during 2016,2021, with the directors collectively attending 97.9%99% of the aggregate number of the meetings held by the Board of Directors and the committees on which they served during the year. All but one of our current directors attendedwho were serving at the time of our 20162021 annual meeting of shareholders. Board of Directors and Corporate Governance JaffraySandler Companies, 800 Nicollet Mall, Suite 1000,Board of Directors and Corporate Governance Nominating and Governance Committee will consider director candidates recommended by shareholders and has adopted a policy that contemplates shareholders recommending and nominating director candidates. A shareholder who wishes to recommend a director candidate for nomination by the Board at the annual meeting of shareholders or for vacancies on the Board that arise between shareholder meetings must timely provide the Nominating and Governance Committee with sufficient written documentation to permit a determination by the Board whether such candidate meets the required and desired director selection criteria set forth in our bylaws, our Corporate Governance Principles and our Director Nominee Selection Policy described below. Such documentation and the name of the director candidate must be sent by U.S. mail to the Chairperson, Nominating and Governance Committee, c/o the Office of the Secretary, Piper JaffraySandler Companies, 800 Nicollet Mall, Suite 1000,900, Mail Stop J12NSH, Minneapolis, Minnesota 55402.Securities and Exchange Commission.SEC. Under our bylaws, only persons nominated in accordance with the procedures set forth in the bylaws will be eligible to serve as directors. In order to nominate a candidate for service as a director, you must be a shareholder at the time you give the Board notice of your nomination, and you must be entitled to vote for the election of directors at the meeting at which your nominee will be considered. In accordance with our bylaws, director nominations generally must be made pursuant to notice delivered to, or mailed and received at, our principal executive offices at the address above, not later than the 90th day, nor earlier than the 120th day, prior to the first anniversary of the prior year'syear’s annual meeting of shareholders. As a result, any shareholder nominees for election to the Board pursuant to our bylaws must be received no earlier than January 6, 2023, and no later than February 5, 2023. Your notice must set forth all information relating to the nominee that is required to be disclosed in solicitations of proxies for the election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (including the nominee'snominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected). Nominating and Governance Committee takes into account many factors. At a minimum, director candidates must demonstrate high standards of ethics, integrity and professionalism, independence, sound judgment, community leadership and meaningful experience in business, law or finance or other appropriate endeavor. Candidates also must be committed to representing the long-term interests of our shareholders. In addition to these minimum qualifications, the Governance Committee considers other factors it deems appropriate based on the current needs and desires of the Board, including specific business and financial expertise, experience as a director of a public company, and diversity. The Board considers a number of factors in its evaluation of diversity, including geography, age, gender, and ethnicity. Based on these factors and the qualifications and background of each director, the Board believes that its current composition is diverse. As indicated above, diversity is one factor in the total mix of informationBoard of Directors and Corporate Governancedirector'sdirector’s attendance, involvement at Board and committee meetings and contribution to Board diversity, prior to recommending a director for reelection. Board of Directors and Corporate Governance During 2016, Annual Compensation for Non-Employee Directors for 20162021 Board Service Board Service60,00080,000 cash retainer•70,00095,000 grant of shares of our common stock Service on a Committee •• Service as a Committee Chair •• Service as Lead Director 20,00030,000 cash retainer Observer Fees Observer Fees ourthe Board after the first month of a calendar year are paid a pro rata annual retainer based on the period they serve as a director during the year. The non-employee director compensation program also provides that a non-employee director will receive a one-time $60,000 grant of shares of our common stock on the date of the director's initial election or appointment to the Board. The annual grant of $70,000$95,000 of shares of our common stock is made on the day of our annual meeting of shareholders to all directors whose service continues after that date. In addition, at the time of a director’s initial election to the Board, he or she is granted $60,000 of shares of our common stock. All equity awards granted to our non-employee directors are granted under the Piper Sandler Companies Amended and Restated 2003 Annual and Long-Term Incentive Plan.In 2016, all of our non-employee directors other than Mr. Frazier participated in the non-employee director compensation program. Mr. Frazier did not participate because he was party to a consulting agreement with Piper Jaffray & Co. That consulting agreement ended on February 26, 2017, and Mr. Frazier began receiving compensation for his Board service under our non-employee director compensation program beginning on March 1, 2017.JaffraySandler Companies Deferred Compensation Plan for Non-Employee Directors, which was designed to facilitate increased equity ownership in the company. The plan permits our non-employee directors to defer all or a portion of the cash payable to them and shares of common stock granted to them for service as a director of Piper JaffraySandler for any calendar year. All cash amounts and share grants deferred by a participating director are credited to a recordkeeping account and deemed invested in phantom shares of our common stock as of the date the deferred fees otherwise would have been paid or the shares otherwise would have been issued to theBoard of Directors and Corporate Governancedirectors'directors’ recordkeeping accounts based on the closing price per share of our common stock on the New York Stock Exchange on the date the dividend is paid. No shares of common stock are reserved, repurchased or issued until the director'sdirector’s service ceases. Following the last day of the year in which the director'sdirector’s service ceases, the director will receive a share of our common stock for each phantom share in their recordkeeping account.director'sdirector’s gifts to eligible organizations dollar for dollar from a minimum of $25$50 up to an aggregate maximum of $1,500$5,000 per year. Employees or consultants of Piper JaffraySandler who also serve as directors receive compensation for their service as employees, or consultants, but they do not receive any additional compensation for their service as directors. Board of Directors and Corporate Governance 201620212016.2021.

Paid in Cash Director

Retainer

($)

Retainer and

Meeting Fees

($)

Awards(1)(2)

($)

($) William R. Fitzgerald 80,000 14,000 95,012(3) 189,012 Victoria M. Holt 80,000 12,000 95,012(3) 187,012 Robbin Mitchell(4) 21,042 1,206 85,074(3) 107,322 Addison L. Piper(5) 30,905 8,000 — 38,905 Thomas S. Schreier 80,000 16,000 95,012 191,012 Sherry M. Smith 80,000 31,000 95,012(3) 206,012 Philip E. Soran 80,000(3) 47,000(3) 95,012(3) 222,012 Brian R. Sterling(6) 79,343(3) 5,000(3) 155,076 249,419(7) Scott C. Taylor 80,000 27,000 95,012 202,012 Fees Earned or

Paid in Cash Annual

Retainer

($) Additional

Retainer and

Meeting Fees

($) Stock

Awards(1)(2)

($) All Other

Compensation(3)

($) Total

($) 60,145 (4) 13,275 (4)(5) 70,029 (4) 1,500 144,949 60,000 35,000 70,029 1,500 166,529 60,000 18,000 70,029 1,500 149,529 55,738 (6) 14,585 (7) 130,051 (4)(8) — 200,374 60,000 15,000 70,029 1,500 146,529 60,000 24,878 70,029 — 154,907 60,000 15,000 70,029 1,500 146,529

(1)(1)(2)(3)Consists of charitable matching contributions made by Piper Jaffray in the amount of $1,500.(4)JaffraySandler Companies Deferred Compensation Plan for Non-Employee Directors.(5)Reflects a pro rata portion of the additional annual cash retainer for the portion of the year that Mr. Fitzgerald served on the Nominating and Governance and Compensation Committees (January 1, 2016 through May 4, 2016), and Audit and Compensation Committees (May 5, 2016 through December 31, 2016).(6)Reflects a pro rata portion of the annual cash retainer for the portion of the year Smith servedMitchell’s service on the Board (Januarybegan on September 27, 2016 through December 31, 2016).2021.(7)Reflectspro rata portion of the additionaldirector at our 2021 annual cash retainer for the portion of the year that Ms. Smith servedmeeting and retired from our Board on May 21, 2021.Nominating and Governance and Compensation Committees (May 5, 2016 through December 31, 2016).(8)Reflects an initial grant of stock of $60,000Board began on January 4, 2021.date of Ms. Smith's election to the Board (January 27, 2016)Company in addition to the annual equity grant made on May 4, 2016.Mr. Sterling’s name.![[MISSING IMAGE: tm2025328d59-box_execcopn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm2025328d59-box_execcopn.jpg)

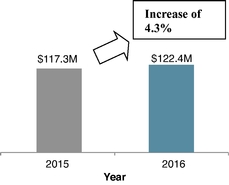

2016,2021, for the third consecutive year, we achieveddelivered record financial performance, including record adjusted net revenues of $736 million. We also enjoyedalmost $2 billion.(1) Our performance was driven by strong profitability with adjusted earnings per share of $4.69, an 11% increase from 2015, and an adjusted ROE of 9.2%. These results reflect the diversified nature ofexecution by our talented professionals across our business andlines as we capitalized on the strong performance by our advisory services (i.e., mergers and acquisitions) and public finance businesses, which are two higher margin businesses that we have targeted for growth overopportunities presented throughout the past few years through selective hiring, internal development, and strategic acquisitions. The strength of these businesses ledyear as the U.S. economy continued to recover from the COVID-19 pandemic. Our record years for each and helped to offset challenging marketsresults reflected high demand for our equity financing and asset management businesses. Our adjusted results exclude an $82.9 million non-cash goodwill impairment charge that we took during the year in our Asset Management segment,services, as well as the costs of amortization of intangible assets related to acquisitions, restructuring and acquisition integration costs, and acquisition-related compensation costs primarily resulting from our acquisition of Simmons.*Highlights of 2016 Financial PerformanceThe following are the key aspectsbenefits of our 2016 financial performance considered bymore scaled and diversified platform, which we have built and strengthened through a disciplined long-term growth strategy anchored around our Compensation Committee when determining executive officer compensation for 2016:Adjusted Net Revenues ($M)(1)Adjusted Earnings Per Share

Adjusted ROETotal Shareholder Returns (TSR)(as of 12/31/2016)

*diluted common share, adjusted pre-tax operating income, and adjusted return on average common shareholders' equityROE (which are used throughout this proxy statement) are non-GAAP financial measures and are further defined and reconciled to the most directly comparable GAAP financial measure in the Appendix A to this proxy statement. Executive Compensation: Compensation Discussion and Analysis Adjusted Net Revenues ($M)* Adjusted Earnings Per Share* ![[MISSING IMAGE: tm223392d1-bc_netrevenpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-bc_netrevenpn.jpg)

![[MISSING IMAGE: tm223392d1-bc_earningpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-bc_earningpn.jpg)

Adjusted ROE*

(as of 12/31/2021) ![[MISSING IMAGE: tm223392d1-bc_roepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-bc_roepn.jpg)

![[MISSING IMAGE: tm223392d1-bc_tsrpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-bc_tsrpn.jpg)

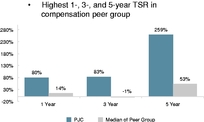

$736.3 million, which represents 71% growth since 2011. Importantly, this revenue growth primarily has occurred in$1.98 billion, reflecting our higher margin businessesstrong execution during the year and the benefits of advisory servicesthe scaled and public finance, a key component of our strategy to shift our business mix to these areas. These businesses, together with asset management, comprised 65% of our adjusted net revenues in 2016.diversified platform that we have built.•$72.6$399.0 million, adjusted earnings per share of $4.69,$21.92, and an adjusted ROE of 9.2%35.1%, demonstrating the significant operating leverage in our business that we receive from both the higher absolute revenue level we producedour scale and the shiftstrong performance, and our disciplined focus on profitable growth, especially in the mix of these revenues to our higher-margin businessesadvisory and capital markets businesses.advisory services2021, our one-year TSR was 1st among our peer group, our three-year TSR was 2nd among our peer group, and public finance.our five-year TSR was at the 62

nd•advisory services and public finance businesses both had record years and helped to offset challenging markets for2021 Financial Performanceequity financing and asset management businesses. Our advisory services businessfirm achieved $305 million in revenues in 2016 due to strong results from our healthcare and consumer franchises and from meaningful contributions from our expansion into the energy sector through our acquisition of Simmons, and the financial institutions sector, primarily through organic hiring efforts. Our public finance business achieved debt financing revenues of $115 million in 2016, largely as a result of its focused efforts to build a broad and diversified public finance franchise through geographic and sector expansion.Importantly, we took several steps in 2016 to execute on our recent organic growth efforts and strategic acquisitions, such as Simmons. Our execution on these initiatives in 2016 drove record adjusted net revenues, adjusted net income, and adjusted earnings per share. AtThese results reflect strong performances across the endbusinesses that make up the scaled and diversified platform that we have built through our long-term growth strategy. We were well positioned through our long-term growth strategy to be able to capitalize on accommodative market conditions through strong execution during the year, which resulted in the best performance in our firm’s history, and our achievement of 2016, our one-long-term strategic goal of exceeding $1 billion in investment banking revenues. Executive Compensation: Compensation Discussion and Analysis three-adjusted net income from $87.4 million to $399.0 million (357% growth), and five-year total shareholder returns ("TSR") wereadjusted earnings per share from $5.72 to $21.92 (283% growth). Just as important, we have grown our number of investment banking managing directors from 90 to 148 (64% growth), and have significantly increased our scale, reach, and relevance in the highest amongmarketplace. These results reflect our focus on growth through hiring and development of productive managing directors, expansion into profitable sector adjacencies, and acquisition and successful integration of leading franchises.peeryear impacted the level of incentive compensation paid to our executive officers for 2021 performance, as more fully discussed below in this Compensation Discussion and Analysis. use for compensation purposes. We believe that the strategy that we set in 2011, which has focused on operating discipline, investment in our higher margin businesses, and execution on opportunistic strategic acquisitions and investments,combination will continue to drivedeliver strong returns for our shareholders. Executive Compensation: Compensation Discussion and Analysis Key Themes from Our Engagement with Shareholders During 2020 and 2021, we sought to engage with our Top 25 shareholders, representing over 50% of our outstanding shares, and held substantive discussions with nine of them, who collectively hold over 35% of our outstanding shares. These were the themes that we heard from shareholders and proxy advisory firms during those engagements: Executive Compensation: Compensation Discussion and Analysis Why You Should Vote FOR 2022 Say on Pay We believe that our company’s record results and momentum are attributable to our long-term growth strategy, of which our 2020 acquisition of Sandler has been a key and transformative pillar. Following our engagement with our shareholders and proxy advisory firms throughout 2021, our Committee considered the feedback that we received, including any concerns that had been expressed. Our Compensation Committee believes that our rationale for entering into the one-time employment agreement with Mr. Doyle in order to complete the acquisition and ensure its success is just as strong now as it was in 2020, and it, along with our 2021 executive compensation program overall, warrants continued shareholder support. ("CEO"(“CEO”), chief financial officer ("CFO"(“CFO”), and each of our three other most highly compensated executive officers for 2016,2021, collectively as the "named“named executive officers."” In addition to our CEO and CFO, this group includes Chad R. Abraham and R. Scott LaRue,Debbra L. Schoneman, our president, James P. Baker, our global co-headsco-head of investment banking and capital markets, and Frank E. Fairman,Jonathan J. Doyle, our head of public finance. Executive Compensation ProgramBased on feedback that we received from shareholders during 2016, our Compensation Committee has approved significant changes to our executive compensation program that are described later in this proxy statement. Some of these changes have been implemented with respect to 2016 compensation, and the remaining changes will be implemented with respect to 2017 compensation. These changes are not fully reflected in the compensation paid to our executive officers for 2016 performance and reported in this proxy statement because our 2016 executive compensation program was established prior to the May 2016 annual meeting of shareholders. Executive Compensation: Compensation Discussion and Analysis Executive Compensation Program2016,2021, consistent with previous years, our named executive officers’ compensation program consisted primarily of three elements: base salary, annual incentive compensation (including cash and restricted compensation), and long-term incentive awards in the form of long-term performance share units ("PSUs"(“PSUs”).Elements of Our 2016 Executive Compensation Program

Base Salary + Annual Incentive Compensation+PSUs=AnnualCompensationMarket-competitiveset amount(unchangedsince 2010)Pay for performancebased onprofitability andindividual performanceVestonly ifcertainperformancemetrics achievedBase Salary

Base salaries have not changed since 2010. Salaries provide a market-competitive set amount of cash compensation for each executive that is not variable. AnnualIncentiveCompensation Annual Incentive Compensation

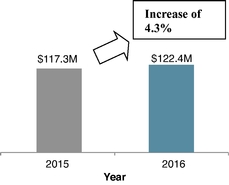

Our annual incentive program directly aligns our named executive officers'officers’ annual incentive pay with our pre-tax, pre-profit provision income, a measure of ourfirm-wide profitability and business line performance. Increasing our profitability is a key objective for us as we seek to maximize long-term value for our shareholders. While our pre-tax, pre-profit provision income was up approximately 4.3% in 2016, the total annual incentive compensation paid to our named executive officers was down approximately 10.9% from 2015, reflecting the impact of the discretion exercised by our Compensation Committee based on business line and individual performance. Annual incentive compensation is paid in a mix of cash and time-vested restricted compensation.compensation in the form of shares of our common stock and shares of certain investment funds.

Long-Term

PSU Awards

Beginning with our February 2017 grant, our PSU award program has been revised to include (1) an adjusted ROE, and (2) a relative TSR performance metric. The PSU award will be earned only if over the 36-month performance period we achieve a certain (1) adjusted ROE andor (2) relative TSR compared to a broad index of financial services companies. In May 2016, our Compensation Committee made its final grant under our historical PSU award program, which vested based on absolute and relative TSR performance metrics. The amount of PSUs awarded to each named executive officer is based on the amount of annual incentive compensation paid to the May 2016 and February 2017 PSU grant was essentially unchanged from 2015.named executive officer. ![[MISSING IMAGE: tm223392d1-fc_totalpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037849/tm223392d1-fc_totalpn.jpg)